Receive our daily digest of inspiration, escapism and design stories from around the world direct to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Daily (Mon-Sun)

Daily Digest

Sign up for global news and reviews, a Wallpaper* take on architecture, design, art & culture, fashion & beauty, travel, tech, watches & jewellery and more.

Monthly, coming soon

The Rundown

A design-minded take on the world of style from Wallpaper* fashion features editor Jack Moss, from global runway shows to insider news and emerging trends.

Monthly, coming soon

The Design File

A closer look at the people and places shaping design, from inspiring interiors to exceptional products, in an expert edit by Wallpaper* global design director Hugo Macdonald.

There’s an odd disparity in a new report on the watch market. According to the Persistence Marketing study, some 29% of watch sales are now online. But, for the ‘premium’ and ‘ultra-luxury’ market, that’s somewhere between 10 and 15%. In other words, it seems that the more exclusive the watch brand, the less enthusiastic it is about selling online.

That is something the watch industry has fought shy of far longer than most other product sectors, the likes of high-end fashion, for example. The high-end watch industry has held fast to the idea that its expensive, craft products deserve and maybe even demand to be purchased with an element of white-gloved fanfare, with expertise to hand and a glass on champagne on offer.

But it looks like a shift may be afoot. As Nicola Andreatta, CEO of Roger Dubuis, explains, attitudes among Gen Y and Millennial consumer as to the way things are sold are changing, 'and it’s simply anachronistic to think that digital sales won’t be its future [of watch sales too]. That a watch brand is not selling online is very hard for younger customers to understand.' In other words, with younger - and, in one stratum at least, wealthier - consumers only having known online shopping, the watch world risks looking Luddite in its commitment to bricks and mortar. This is especially so as auction houses the likes of Sotheby’s and Christies now sell a majority of their watches on line, with online-only watch sales breaking records year-on-year.

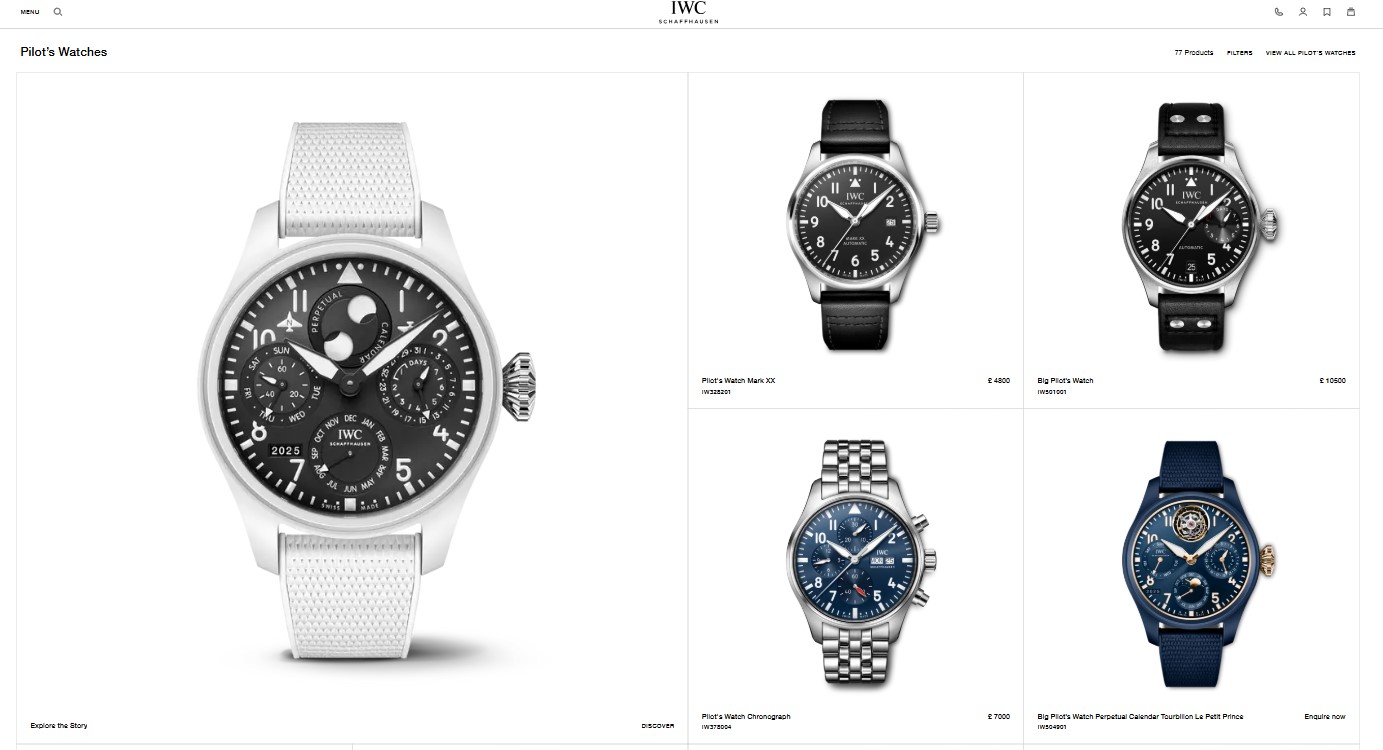

The IWC web page

The IWC watch available to purchase online

More luxury watch brands, if not launching their own portals, are at least allowing online sales though authorised retailers. Indeed, while most brands now have their own flagship boutiques, the traditional distribution network of selling through third party retailers is likely one reason why there’s been a reluctance to launch their own e-commerce operations and so compete with long-respected partners.

But the industry is, it’s said, also less open to the idea of being a committed part of an online sales ecosystem through which it’s easier for potential customers to compare models and prices. There has also been the desire among heritage brands to keep clear water between themselves and the so-called start-up and ‘micro-brands’, whose comparatively more accessible prices have only been possible as result of embracing on-line sales.

'Online selling has been a completely game-changer for the watch industry, and not just in terms of reach - the money saved is money used to develop the product,' argues Jerome Burgert, founder of French brand Serica, launched seven years ago and now selling in over 70 countries. He says the slowness of the wider industry to embrace online sales in comparable to its historic slowness in responding to the nearly category-killing advent of quart watches in the 1970s.

'The [wider] industry has underestimated how willing people are to buy more and more things online now, including much more expensive watches than we sell, as the used watch market suggest,' he adds. 'A lot of the established brands have spent too long looking down on online sales.'

The Serica 6190 Field

Might we expect change? Keeping in mind that making watches and selling them are different skill-sets - and the luxury watch industry is not yet as adept at the latter - any change will come slowly, albeit that there have been efforts to make their e-commerce efforts as distinctive as their real world ones: Piaget, for example, is not alone in having developed a more virtual reality-based online salon, while IWC has an augmented reality viewer. The application of AI may in time bring more seamless ways of trying on a watch without literally trying it on.

Receive our daily digest of inspiration, escapism and design stories from around the world direct to your inbox.

In the meantime more online-minded brands are aiming at a best-of-all-worlds arrangement, accommodating wholesale, their own e-commerce platforms and physical shops. Omega, for example, has pulled this off without, it says, damaging any of its existing relationships. Much like the fashion industry - while hoping to avoid a world of fast buying, multiple returns and damaged packaging - there’s a growing acceptance that even if physical stores still allow a customer to handle the goods, increasingly the final transaction will happen online.

Josh Sims is a journalist contributing to the likes of The Times, Esquire and the BBC. He's the author of many books on style, including Retro Watches (Thames & Hudson).